Understanding Gold’s Performance Amid Ongoing Fed Rate Discussions

August 2024

The Royal Mint

Category: Invest

The gold price continues to climb higher, with a new all time high in US dollar terms – trading around $2,500. The GBP gold price performance has been slightly tempered on account of sterling’s relative strength against the US dollar. The GBP gold price still trades above £1,900, touching highs last seen in April-May.

So, what is moving the gold price?

The main data point under inspection by investors is the US Federal Reserve’s (the Fed) upcoming September interest rate decision. On Wednesday, the Fed released minutes from its previous rate meeting, where ultimately, policymakers decided to leave interest rates unchanged. The minutes provide some insight into the balance of opinion on the future path for interest rates, and should economic data continue to register as expected, the market is fully expecting a rate reduction in September. The chairman of the Fed, Jerome Powell, is due to give an address at the Jackson Hole symposium on Friday (23/08) and this is likely to set the tone for the bank’s future interest rate policy. Investor will be carefully watching for guidance.

Several committee members cited higher unemployment as a rationale for lowering rates at the previous meeting, and with revised non-farm payrolls data showing a less rosy picture for the US labour market, it seems all the key indicators are supporting a move in rates. US dollar weakness is certainly reflecting this, having lost around 5% of its value versus major trading partners since a mid-summer peak.

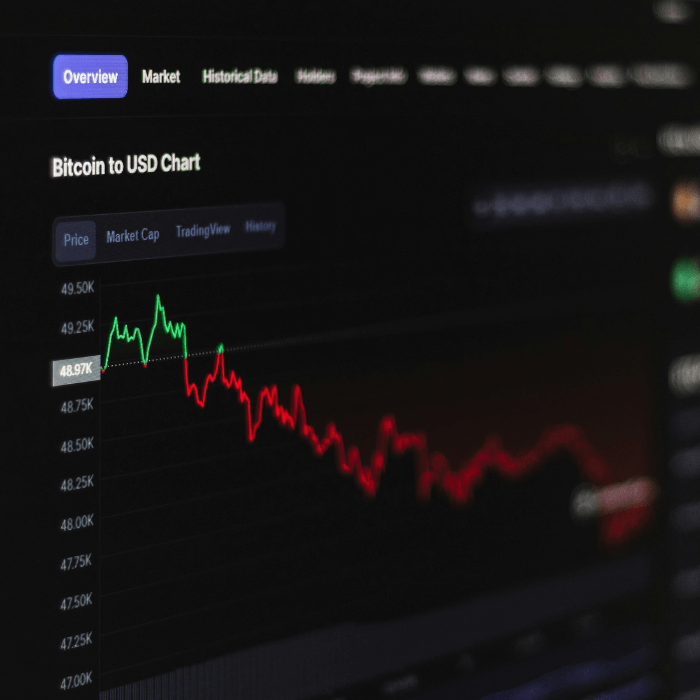

According to trade data where market players place ‘bets’ on the future direction of the US policy (interest) rate, two-thirds of the market believe a 0.25% percentage point drop is in play, where the remainder has a 0.5% percentage point reduction as the likely outcome. With the gold price having moved decisively higher in expectation of the rate drop, anything but a larger 0.5% step reduction could possibly see the gold price consolidate lower.

In July in the UK, the Bank of England (BoE) committed to its first interest rate reduction in over 4 years, where the base rate had sat at 5.25% for a whole year prior. Inflation had been trending around the target 2% level in recent months, however, the latest UK inflation reading showed a slight uptick to 2.2% annual inflation. The blip higher was attributed to energy prices dropping slower than they had previously.

Stubborn inflation in the services sector has been a key focus for UK policymakers, particularly as it is seen as a better gauge of domestic price pressure. Whilst the service sector inflation number came in better than expected at the latest reading in June, the UK unemployment rate also dipped lower than expected which could uplift wages and cause more consternation for policymakers.

The BoE policy rate is currently set at 5% with most analysts expecting a further rate cut in Q4 2024. Despite the interest rate differential with the US, the pound has been strengthening against major trading currencies – including US dollar - and this has constrained gold’s performance in GBP terms and could perhaps provide an entry opportunity for UK investors. Optimism around the new majority government, and a more attractive interest rate compared to European peers, has also seen the British pound well bid on currency markets. Opinion is however split on whether recent GBP strength is sustainable, and the biggest test of this will perhaps be presented in the Autumn budget scheduled for October 30.

Considering gold’s performance in relative currency terms is largely semantics when looking at the long-term performance of gold versus fiat currencies. And while the pound’s strength can provide short term opportunity, gold’s allure is more enduring when comparing its performance against traditional asset classes (stock and bonds). To view a snapshot of gold’s performance over the last 20 years, please visit: Diversify With Gold | The Royal Mint.

Sources

BCC Economic Forecast - British Chambers of Commerce

UK inflation rate ticks up to 2.2% in first rise this year - BBC News

Fed is predicted to deliver three quarter-point rate cuts this year: Reuters poll | Reuters

Gold, Silver, Copper: An Optimistic Outlook? - OpenMarkets (cmegroup.com)

Is UK services inflation finally on the right path? (ft.com)

Notes

The contents of this article are accurate at the time of publishing, are for general information purposes only and do not constitute investment, legal, tax or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.