Precious metals are often considered safe-haven assets, that often increase in popularity when there is economic or political uncertainty. The priorities and decisions of US presidents can significantly impact global markets, and investor sentiment.

We’ve already explored how previous presidential election campaigns impacted gold, and 3 major ways that US elections can affect prices but data from the US Mint poses another interesting question.

Demand for Bullion Coins

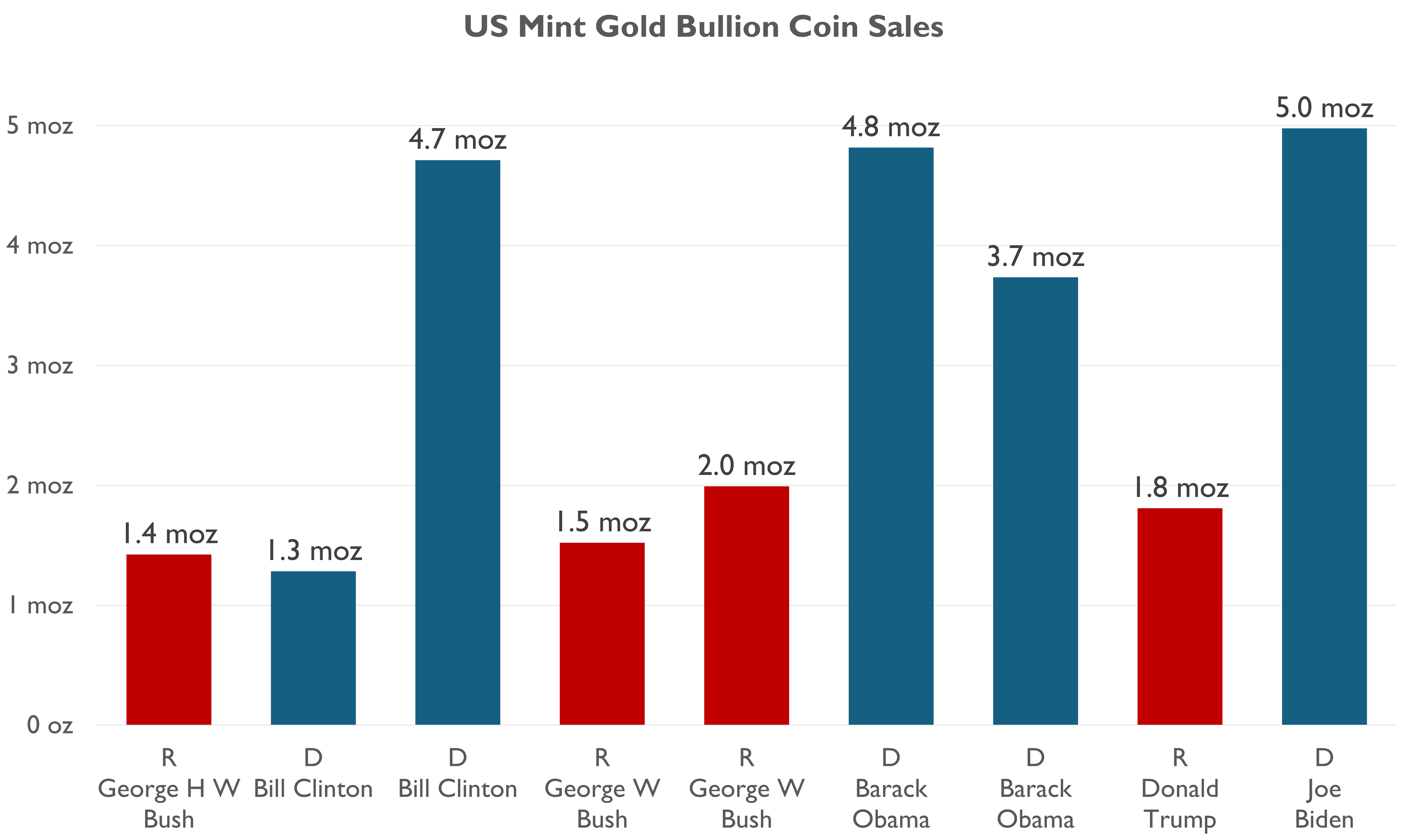

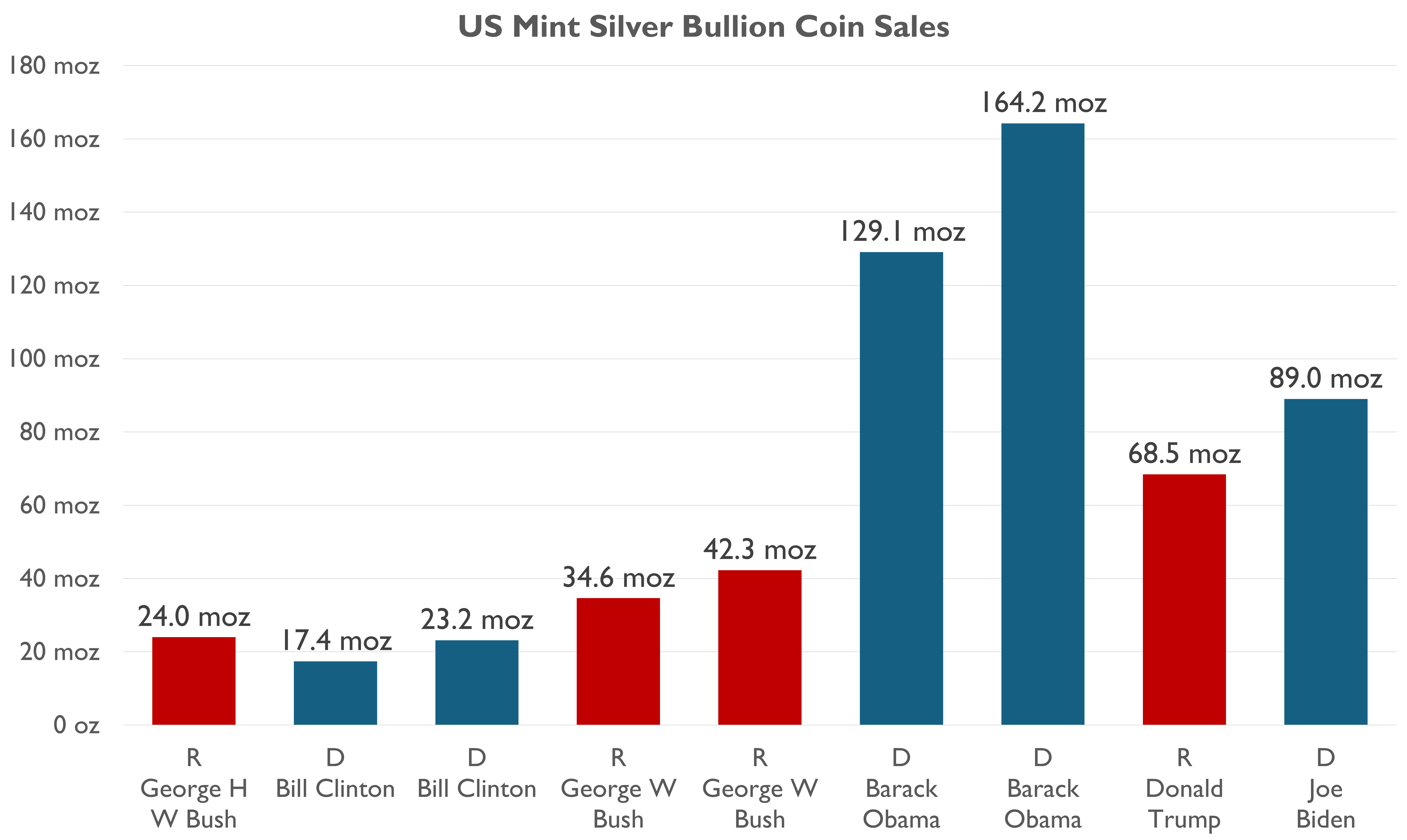

Naturally, the US Mint’s American Gold Eagle and American Silver Eagle coins dominate the bullion coin market in the US. The US Mint’s publicly available sales data paints an interesting picture.

The graphs below show the total volume of gold and silver coins sold (in troy ounces) under each administration since George H W Bush – excluding sales in October, November and December of presidential election years as sales in this timeframe are likely to be particularly influenced by investors’ anticipation of who the next president might be.

p>

p>

Source: US Mint sales data

Clearly, demand for both gold and silver bullion coins has historically been higher under Democrat presidents than under Republican presidents.

Some have speculated that the reason for this may be that ownership of physical assets (and particularly gold and silver) may resonate more strongly with those who have a conservative economic philosophy. Indeed, fiscal conservatives were central to the inception of the American Eagle bullion coin programme. Texas Republican Ron Paul and investment banker Lewis Lehrman laid the foundations for launching an American bullion coin by authoring a minority report of the US Gold Commission in 1982. A few years later, it was a Republican President, Ronald Reagan, who signed the Gold Bullion Coin Act 1985 into law (though the bill was introduced to the Senate by a Democrat Senator). So, do fiscal conservatives add to their precious metals holdings when Democrats are making the big decisions?

Notes

The content of this article is accurate at the time of publishing, is for general information purposes only, and does not constitute investment, legal, tax or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, legal, tax and/or accounting advisers.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.