How Will Significant Changes to Capital Gains Tax (CGT) Affect You and What is the Solution?

The Royal Mint

Category: Invest

Updated: November 2023

In the ever-evolving landscape of financial policies and taxation, the UK's Capital Gains Tax (CGT) has recently come under the spotlight. The government has unveiled notable changes to the CGT annual exemption amounts, setting the stage for profound implications for investors, trustees, and the wider public. For those unfamiliar, CGT is levied on the profit or gain made when an asset, such as property, shares, or some forms of bullion, are sold. While the concept of CGT isn't new, the forthcoming changes will reshape the financial strategies of many. This article aims to provide a comprehensive overview of these changes, exploring the reasons behind the government's decision and delving into the potential impacts on individual financial portfolios. Furthermore, in light of these modifications, we'll shine a spotlight on certain investment options, like bullion coins from The Royal Mint, which remain exempt from CGT and may offer a silver lining amidst these changes.

Overview of the New CGT Changes

The crux of the recent announcement revolves around a planned significant reduction in the annual exemption amount for Capital Gains Tax. This exemption amount defines the threshold of gains an individual can earn from the sale of assets within a year before CGT becomes applicable.

Historically, the annual allowance for CGT had been set at £12,300 for the 2021/22 tax year, and it was anticipated to remain frozen at this amount until April 2026. However, in a surprising move, the Chancellor has announced that this amount will be substantially reduced in the coming years:

- From 6 April 2023, the CGT annual exemption amount has decreased to £6,000.

- From 6 April 2024, it is set to decrease further to £3,000.

Deloitte forecasts that these changes are expected to raise £1.6 billion by the end of the 2027/28 tax year [1], suggesting that the government is seeking alternative avenues for revenue generation without directly increasing income tax or National Insurance Contribution (NIC) rates.

This move will undoubtedly impact a vast number of individuals and trustees, prompting many to re-evaluate their investment strategies and financial decisions for years to come.

Implications for Investors

The cascading effects of these adjustments to the CGT annual exemption amount will be diverse; especially for investors in the higher tax bracket.

This is because, a higher rate taxpayer who previously utilised the entire £12,300 annual exemption could see themselves paying up to £1,764 more in CGT during 2023/24 and a staggering £2,604 more in 2024/25 compared to the previous year.

These reductions also have implications for the rate at which CGT is charged. Those who fall within the basic rate band and don't fully utilise it might now see some of their CGT liabilities charged at 10% (or 18% for residential properties) rather than the standard 20% (or 28% for residential properties).

Furthermore, trustees are not immune to these changes. Typically, trustees have a CGT annual exemption amount equal to half that of individuals, meaning their exemption will also see a proportionate reduction.

While this paints a somewhat sombre picture, there remains a glimmer of hope for savvy investors. Assets such as bullion coins from The Royal Mint continue to offer a unique advantage, remaining wholly exempt from CGT. With future changes potentially shaking the financial landscape, such avenues might serve as a strategic option for those looking to safeguard their gains.

The Distinctive Advantage of Bullion Coins

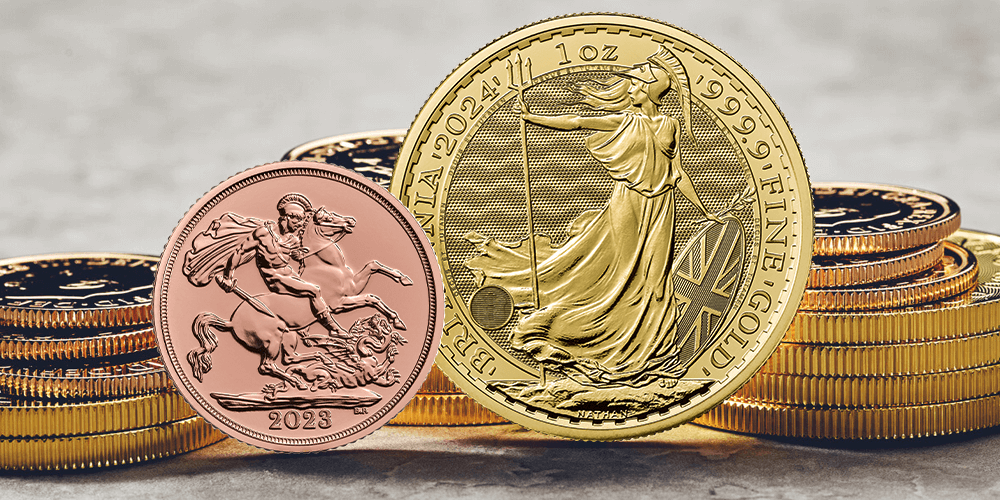

Considering the shifting landscape of the Capital Gains Tax environment, it's opportune to revisit the notable advantage of bullion coins, specifically UK bullion coins offered by The Royal Mint. As highlighted in previous articles, these coins retain their unique CGT exemption due to their status as legal British currency. This includes sought-after flagship ranges such as gold, silver and platinum Britannia coins, as well as Sovereigns.

To put it in simpler terms: irrespective of the amount of bullion coins purchased or sold, the profits remain untaxed. When comparing this to the potential CGT liability from the sale of other assets, the allure of bullion coins becomes undeniably clear.

Additionally, given the dwindling CGT allowances, the exemption on bullion coins becomes even more significant. For individuals aiming to shield substantial gains or those simply wishing to navigate the investment landscape with fewer tax complications, bullion coins from The Royal Mint present an increasingly attractive proposition for those looking to plan and shape their investment portfolio.

Looking Forward: Preparing for the Future

The realm of taxation is ever-evolving, with policies often reflecting the changing economic and political landscapes. As the UK navigates its post-pandemic recovery and grapples with international financial pressures, it's not unexpected to witness shifts in tax structures.

What can Individuals and Investors do?

- Stay Informed: Keeping abreast of the latest tax policies, especially concerning capital gains tax rates, is essential. Trusted sources like HMRC and specialised tax websites offer in-depth analyses and insights.

- Consult Experts: When in doubt, seeking guidance from tax professionals can shed light on complex areas, ensuring you're not caught unprepared.

- Diversify Investments: Given the shifting CGT landscape, now might be the time to reconsider your investment portfolio. As previously discussed, bullion coins from The Royal Mint offer tax benefits that other assets may not.

While uncertainty prevails, one thing is clear: preparation and adaptability will be crucial. By being proactive and understanding the nuances of UK capital gains tax, individuals can better position themselves for the fiscal changes on the horizon.

Frequently Asked Questions on Capital Gains Tax Changes

1. What is Capital Gains Tax (CGT)?

Capital Gains Tax (CGT) is a levy on the profit made when selling an asset. Essentially, if an asset like property, shares, or bullion appreciates in value from the time of acquisition to the time of sale, the profit (or "gain") may be subject to CGT. It's worth noting that only the gain is taxable, not the entire selling price.

2. How does Capital Gains Tax work?

CGT applies once an asset is sold and a profit is realised. After accounting for any exemptions or allowances, such as the capital gains tax allowance, the remaining gain is multiplied by the applicable CGT rate (either 10%, 20%, 18%, or 28%, depending on various factors) to determine the tax owed.

3. How much is Capital Gains Tax?

The rate of CGT depends on the asset type and the individual's taxable income. For most assets, basic rate taxpayers pay 10%, while higher-rate taxpayers pay 20%. For residential properties, these rates jump to 18% and 28%, respectively.

4. Who pays Capital Gains Tax?

Both individuals and trustees can be liable for CGT if they sell an asset at a profit. However, certain assets, like bullion coins from The Royal Mint, are exempt for UK residents due to their legal currency status.

5. When do you pay Capital Gains Tax?

CGT is typically due on gains made in a given financial year, and it should be paid by the 31st of January in the following year. This means if you realised a gain in the 2023/24 tax year, for instance, your CGT would be due by 31st January 2025.

References:

The contents of this article, accurate at the time of publishing, are for general information purposes only, and do not constitute investment, pensions, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, pensions, legal, tax and/or accounting advisors.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.