The content of this article, accurate at the time of publishing, is for general information purposes only, and does not constitute investment, legal, tax, or any other advice. Investments in physical bullion are not regulated by the Financial Conduct Authority. The value of your investment can go down as well as up, and past performance is not indicative of future results. Before making any investment or financial decision, you may wish to seek independent advice from your financial, legal, tax and/or accounting advisers.

The Royal Mint recently reported a surge in sales of bullion coins in the UK via its website. Revenue from the sale of bullion coins in 2024 was 47% higher than in 2023, and 197% higher in the year's final quarter. The number of customers buying bullion directly from The Royal Mint also rose 9%, setting a new record.

Three main factors may be behind the surge:

- Elections across the world

- Changes in taxation

- Price momentum

Elections and Geopolitical Uncertainty

2024 was a historic year for elections globally. More people were eligible to vote in an election last year than in any other year in history, and elections took place in major centres of geopolitical power or tension including the USA, UK, France, the EU, India, Taiwan, Japan, and Iran. Elections inevitably create uncertainty, which can lead to an increase in demand for perceived ‘safe-haven’ assets like precious metals, as investors seek to protect their portfolios from potential changes in the equity market.

As new regimes begin their programmes of change, and incumbents double down, uncertainty persists. Markets are still assessing what a second-term Trump administration means in practice; what might the impacts of tariffs be, how do other nations react, and how significantly will US foreign policy change? Some investors have positioned to enjoy the possible ‘Trump bump’ in the equity and crypto markets, but others may be turning to perceived safe-havens to diversify their portfolio and protect their wealth against so-called ‘black swan events’ that are difficult to predict.

After some net selling in Europe and North America at the end of 2024, gold exchange-traded products (like The Royal Mint’s Responsibly Sourced Physical Gold ETC) appear to be returning to positive inflows. Physical bar and coin sales via The Royal Mint’s website remain elevated, suggesting that the resolution of global elections has not necessarily reduced demand for safe-haven assets.

CGT Changes: Falling Allowances and Rising Rates

Capital Gains Tax (CGT) rules can vary depending on whether the taxpayer is an individual or a trustee, the rate of Income Tax an individual pays, and the nature of the capital gain generated. For simplicity, the below (which is an illustrative example only, and should not be relied on as a guarantee of what you may be entitled to) refers to individuals unless otherwise stated – further details can be found on the government’s website: https://www.gov.uk/capital-gains-tax.

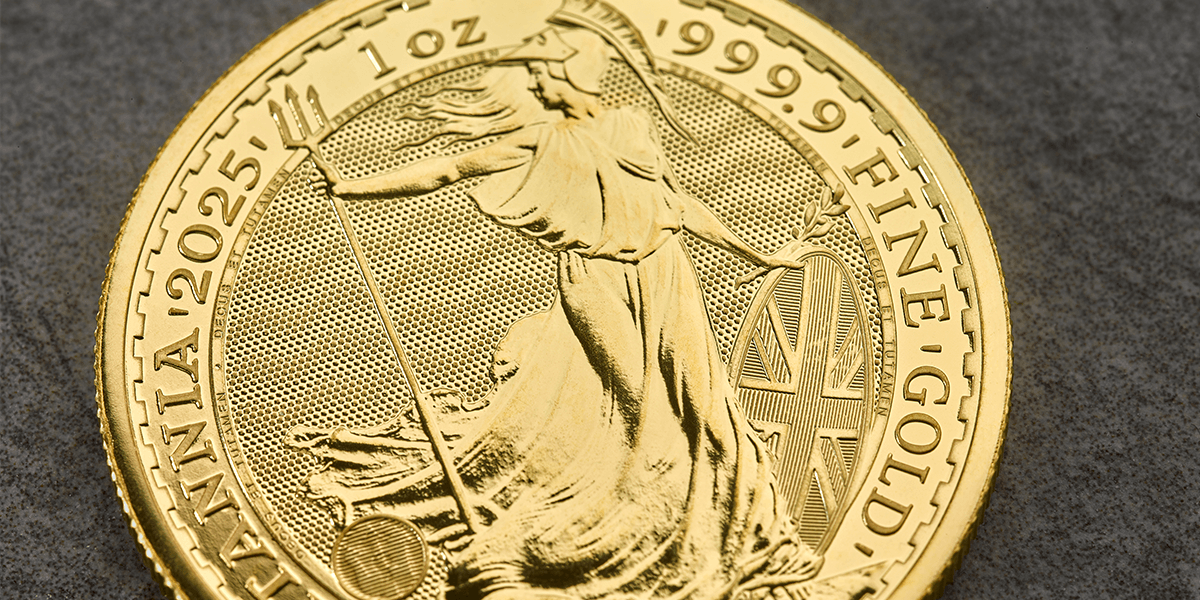

All coins that are legal tender in the United Kingdom, including Sovereigns, Britannias, and Royal Tudor Beasts coins, are exempt from Capital Gains Tax for residents in the UK. This means that, unlike many other assets, the profits made from selling UK coins are not subject to tax.

In recent years, Capital Gains Tax thresholds, e.g. the amount of profit (from an asset sale) a person can make before they have to pay CGT, have reduced. In 2022/23, individuals could earn up to £12,300 of profit before having to pay CGT. The threshold was reduced to £6,000 in 2023/24 and is now £3,000 (£1,500 for trustees). So in 2024/25, individuals must pay Capital Gains Tax on any and all profits from non-exempt assets if they generate more than £3,000 of profit during the tax year.

- 2020/21 – Threshold increased from £12,000 to £12,300

- 2023/24 – Threshold decreased from £12,300 to £6,000

- 2024/25 – Threshold decreased from £6,000 to £3,000

It is important to note that these thresholds refer to the total value of all profits from non-exempt assets. So if an individual makes a £2,000 profit from the sale of Asset A, and £2,000 from the sale of Asset B, their total profit would be £4,000, thus they would be liable to pay Capital Gains Tax as their total profit exceeds the £3,000 threshold.

In addition to the falling Capital Gains Tax threshold, the rate of CGT has also been increased. Effective from 30 October 2024, the amount of tax that individuals must pay on profits above £3,000 has risen from 10% for basic rate taxpayers and 20% for those paying the higher and additional rate of Income Tax, to 18% and 24% respectively.

The illustration below shows the impact of this on a higher rate taxpayer generating £15,000 of profit from the sale of non-CGT exempt assets.

| 2020/21 | £15,000 profit minus the £12,300 allowance = £2,700 of taxable gains £2,700 taxed at the 20% rate = £540 of CGT payable |

| 2024/25 | £15,000 profit minus the £3,000 allowance = £12,000 of taxable gains £12,000 taxed at the 24% rate = £2,880 of CGT payable |

Following these changes, investors looking for CGT-exempt assets may be increasingly considering bullion coins which allow them, if eligible, to gain exposure to precious metal prices without having to apportion some of the profits to Capital Gains Tax.

Please be aware that thresholds and rates are correct as of 31 January 2025, but may change in the future. You should do your own research and seek advice from a tax professional if unsure.

Price Growth and Comparisons

The recent rise and rise of precious metal prices appears to have caught the attention of investors looking for returns. In 2024, gold rose 27% in US Dollars, while silver rose 22%.1 By way of contrast, the FTSE 100 delivered a total return of 9.7%, while the FTSE 250 was up 8.1%.2 The average property price in England and Wales fell by 2% according to the Acadata House Price Index.3

For those investing in GBP, precious metals have performed even better. In 2024, gold rose 28% while silver rose 24%, and due to the fluctuating value of the Pound against the US Dollar, this trend has continued into 2025. Gold priced in GBP has new all-time highs having risen 5.5% since the first LBMA fix of the year on 2 January, while gold in USD is up 5.4% as of the afternoon of 30th January.4

Over the past 20 years, gold priced in GBP has had a compound annual growth rate of over 10% per year, demonstrating that the yellow metal can be a source of real returns. Silver’s average annual growth has lagged gold only slightly at 9.9%.

After a strong 2024, and encouraging signs in 2025, bullion coins offer a compelling option for many interested in portfolio diversification and wealth preservation. As market conditions continue to evolve, the demand for these safe-haven assets could remain strong, solidifying their position for many as a cornerstone of investment strategies worldwide.