Alternative Investments: Three Ways to Start Investing

Category: Invest

As global financial markets go through a challenging period, more investors are turning to what are traditionally viewed as ‘alternative investments’ to boost their portfolio. When selected wisely, alternative investments can offer a number of benefits to investors; lowering volatility, enhancing returns over the long-term, and diversifying an investment portfolio

The Royal Mint's research shows that 1 in 8 (13%) UK investors are considering investing in alternative investments in the future, on top of the 58% who already hold alternative investments in their current investment portfolio. Here’s the lowdown on how you can start investing in alternative investments, and the ‘need to knows’ when investing.

1. Consider Your Investment Time Horizon

As we have seen in recent years, markets can be incredibly volatile, rising and falling quickly. If you are thinking of investing, it is important to consider how long you intend to invest for. By committing to investing over the long-term, you may be able to ride out any market dips and be less sensitive to short-term volatility.

Furthermore, alternative investments such as property can provide regular dividend payments. Gold and precious metals do not generate a yield and only achieve profit when the asset is sold. However, precious metals are often seen as a store of value and inflation-hedge as the price has generally tended to appreciate at a faster rate than inflation over time.

For example, gold has provided an annualised return of over 10% in the past twenty years, while inflation has averaged around 2.5%.1 However gold has returned 1.4% this year so far (as of 19th September 2023).2 This highlights the value of understanding the performance of assets over the long-term in order to create a robust investment portfolio.

2. Think About ‘Physical’ Vs ‘Digital’ Investments

The alternative asset class includes a range of investments spanning from collectible goods to watches, non-fungible tokens (NFTs), and crypto. For those considering investing, it is important to reflect on your preference for physical investments versus investments held digitally.

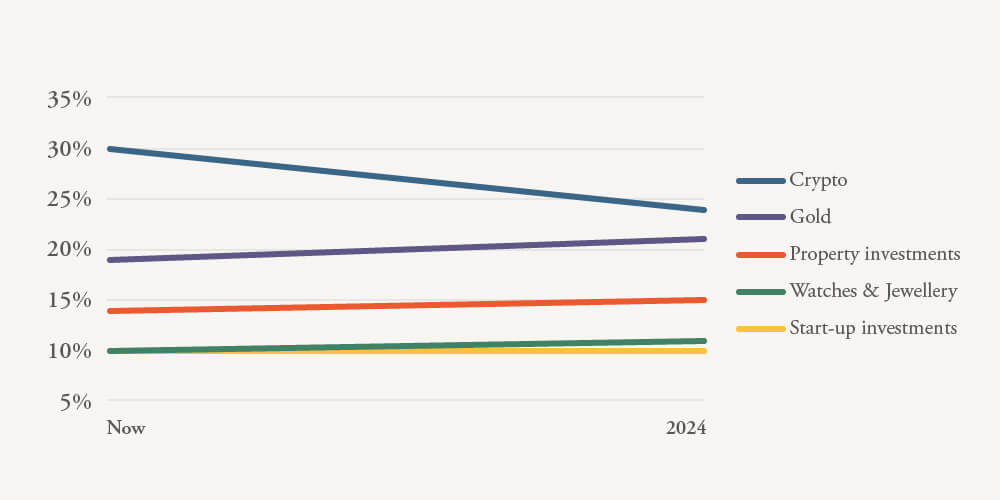

Crypto’s investment appeal is set to drop in 2024 as more UK investors turn to gold

Percentage of investors holding alternative investments in their portfolio now, and in 12 months’ time

Physical investments such as watches and property can incur costs such as insurance, storage, or repairs. However, these assets are usually directly owned by individuals and may have a much lower level of counterparty risk. These assets aren’t sat on another companies’ balance books, nor are they subject to decisions taken by companies that can affect share prices. Physical assets like these can be enjoyed, handled, and inherited easily.

For those looking for a complete solution, or who do not wish to take delivery of their bullion, The Royal Mint enables investors to store physical bullion in our own high-security vault, or in safety deposit boxes on our secure site in South Wales. While investors may not always be able to liquidate their physical assets and receive the cash immediately, many categories such as coins, watches and antiques enjoy a buoyant secondary market. The Royal Mint buys and sells pre-owned coins at competitive prices, and if your coin is already stored in The Royal Mint’s vault, we may be able to offer you a better rate and quicker access to the cash.

Assets held digitally almost always come with a degree of counterparty risk and investors should do their research to ensure they’re comfortable dealing with companies who could impact the value of the assets, for example by becoming insolvent. On the other hand, digital assets may potentially be cheaper to purchase as there may be no associated manufacturing cost. In recent years, alternative investments have become increasingly accessible to investors through new products and technologies.

The Royal Mint has launched DigiGold and a physical gold ETC (The Royal Mint Responsibly Sourced Physical Gold ETC) which is listed on various stock exchanges including the London Stock Exchange. These products are attractive to investors who do not want to take delivery of physical bars or coins. These products give investors access to the gold price and the flexibility of being able to manage holdings digitally and buy from as little as £25. It is vital to do your research and consider your preference for physical vs digital investments as they can come with different advantages and disadvantages.

3. Pick an Investment That Works Best for You

When many consider starting their investment journey, it is common to start thinking about potential investment assets. With thousands of investments on offer to new investors, it can be tricky to find the right one for your portfolio that matches your investment goals. ‘Get-rich quick’ schemes should be treated with the utmost caution and investors may wish to focus instead on quality investments that align with their aims and seek advice or guidance where appropriate.

In the alternative investments space, there are several factors to consider when starting out. By considering the below questions, you can start to research the various alternative investments and then have a greater understanding of which asset aligns best with your aims.

- How much do you want to invest?

- What level of risk are you willing to take?

- How hands-on do you want to be with your investments?

- What are your investment objectives?

- Are there any additional costs associated with the investment?

- Do you trust the associated companies that may impact the value of your investment?

- Do you need support from a financial adviser or independent investment advice?

At The Royal Mint, we have welcomed tens of thousands of new investors in recent years who are starting their investment journey in precious metals. Gold and other precious metals are increasingly becoming a mainstream choice for investors who are looking to diversify their portfolio and hedge against inflation. Find out more about gold investing here: https://www.royalmint.com/invest/get-into-gold/

The contents of this article, accurate at the time of publishing, are for general information purposes only, and do not constitute investment, pensions, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, pensions, legal, tax and/or accounting advisors.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.

References: