Appetite for Alternative Investments Increasing

The Royal Mint

Category: Invest

The Royal Mint, the UK’s home of precious metals, has today revealed new data showing increasing appetite among UK investors for alternative investments as more and more look for stronger returns from their investment portfolios. Alternative investments are classed as financial assets that do not fall into traditional stocks, shares and bonds categories. For example, crypto and commodities, including gold and other precious metals, and real estate.

A new poll of over 2,000 UK investors, undertaken by The Royal Mint, shows increasing appetite among UK investors for alternative assets, with over half (58%) of UK investors surveyed currently holding at least one alternative investment in their portfolio. UK investors in the asset class plan to increase their monthly alternative investments by 11% on average, rising to 13% among Gen-Z investors. 36% of those who haven’t previously invested in the asset class said they would consider investing in alternative assets in the future.

The growing popularity of alternative investments is mainly being driven by UK investors turning their attention to financial returns. Nearly two-thirds (63%) of alternative investors said they were motivated to invest whilst UK inflation was outstripping high-street bank savings rates. This reflects recent analysis from the Financial Conduct Authority revealing that 40% of all cash (£260bn) held in easy-access savings accounts with Britain’s nine biggest banks was earning less than 1% in interest at the end of June 2023.2

The growing popularity of alternative investments among UK investors is being reflected in The Royal Mint’s own data, with a 17% year-on-year uplift in first-time precious metals investors during the first half of 2023. Precious metals such as gold and silver are increasingly becoming a go-to, mainstream investment choice for investors, with the volume of investments in the precious metals increasing by 10% and 16% year-on-year respectively in the first 6 months of the year. This increase was distributed evenly across age groups during this period respectively, highlighting the mainstream investment appeal of gold and other precious metals to all investor types.

Low Returns from Equities Pushes More Investors into Alternatives

Increasing awareness of investment returns in the current macroeconomic climate is pulling more UK retail investors into alternatives to stocks, shares, and bonds. 68% of UK investors said they are on the hunt for better returns from their investments because of the cost-of-living crisis, with half (51%) believing that alternative investments offer better returns in the long-term than traditional stocks and shares. Whilst the FTSE all-share index has offered poor returns to UK investors this year, a majority (55%) of alternative investors said they had previously made profit from holding alternatives in their portfolio.

Over a quarter (26%) of alternative investors say they are motivated to invest in the asset class in order to build their wealth, rising to 31% among Gen-Z investors. 65% of investors said they added alternative investments into their portfolio to diversify their investments.

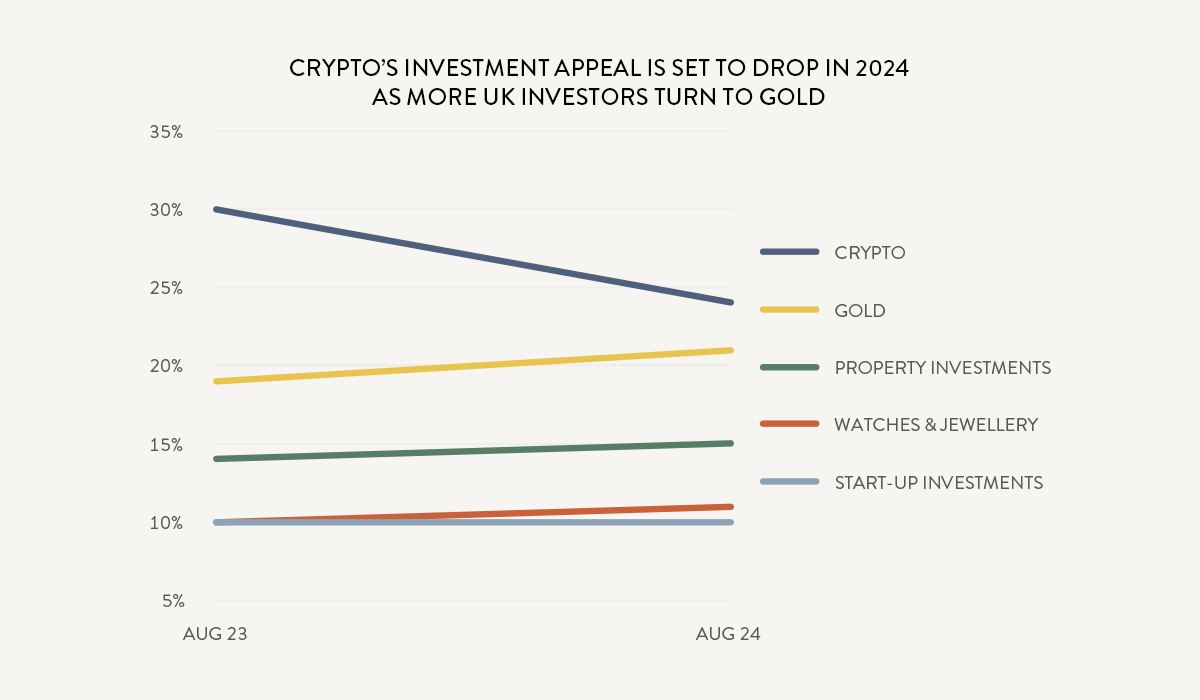

Whilst many investors look to alternative investments to bolster their portfolio returns, the survey looked at the most popular alternative investments in 2023 and how this is set to change in the next year. 30% of UK investors currently hold crypto investments but this is set to drop to 24% by 2024 as many reassess whether decentralised currencies are a good store of wealth in the long-term.

Whilst crypto is expected to reduce in appeal, 21% of UK investors are set to hold gold in their portfolio by 2024, increasing from 19% right now. This reflects a growing demand among UK investors for ‘safe haven’ assets, with The Royal Mint’s data showing a 26% uplift year-on-year in the volume of gold investments during 2022. In the last five years, UK investors have benefited from a 64.8% increase in the value of gold, highlighting the value of the precious metal as a hedge against inflation (data as of 4th September 2023).3

Commenting on the research, The Royal Mint’s Director of Precious Metals Andrew Dickey, said: “As high street savings rates and returns on the stock market remain low the pendulum has swung towards investments with the potential to offer better returns. It is clear from the data that investors are becoming more pragmatic about their portfolios and turning towards what are traditionally viewed as ‘alternative investments’ in order to boost their portfolio during this period.

At The Royal Mint, we’ve seen an uplift in gold and silver investments in the first half of the year as investors turn to alternative investments as a means to diversify their portfolio, beat inflation, and generate wealth in the long-term. Whilst the data shows that bitcoin is set to drop in its investment appeal over the next year, more are investing in gold and precious metals in order to benefit from the investment’s ‘safe haven’ status. It is clear that precious metals are becoming a more mainstream investment choice for UK investors, having delivered positive returns for investors in recent years.”

The contents of this article, accurate at the time of publishing, are for general information purposes only, and do not constitute investment, pensions, legal, tax, or any other advice. Before making any investment or financial decision, you may wish to seek advice from your financial, pensions, legal, tax and/or accounting advisors.

This article may include references to third-party sources. We do not endorse or guarantee the accuracy of information from external sources, and readers should verify all information independently and use external sources at their own discretion. We are not responsible for any content or consequences arising from such third-party sources.